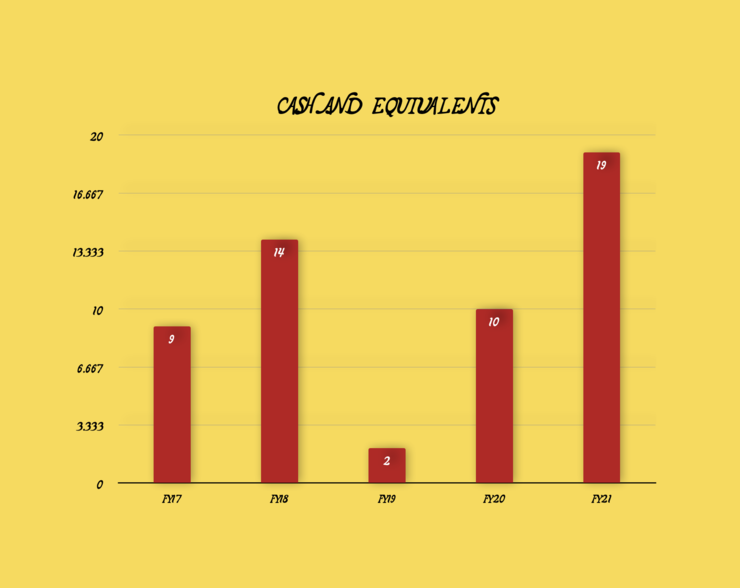

New Penny Stock Idea-: Price 23 Rs | Manufacturing plastic processing machines | Almost debt free company | Highest every cash balance of Rs 19 cr.

NEW PENNY STOCK IDEA

Current price-: 23 Rs

Marketcap-: Rs 140 crs

Company Name-: https://wp.me/p8WeZG-1ky

( Click on the above Link for name )

Sector-: Capital Goods

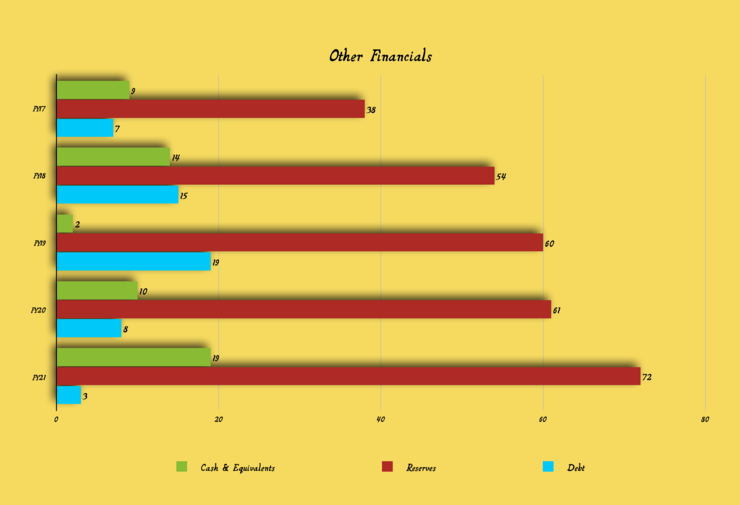

Key Aspects-: Negligible debt | Cash Balance of Rs 19 Crs

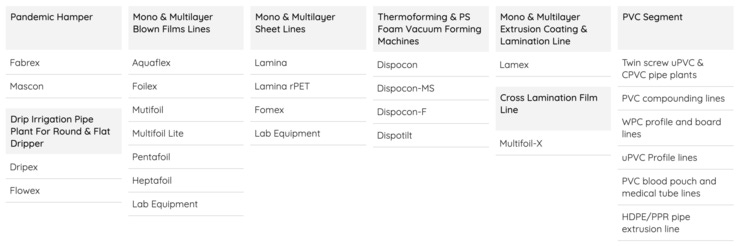

About-: This is an 35 years old almost debt free rajkot Gujarat based company engaged in manufacturing plastic processing machines, specifically extrusion and post extrusion machines for producing films, sheets and various thermoformed and vacuum formed products. Company has cash balance of Rs 19 crs and has ambitious plans for capex of around 100 crs+ for the coming period.

Note-: Penny stocks are extremely risky and can lead to complete loss of capital. DARKHORSESTOCKS or any of its members would not be responsible for any loss.

Managements comments

Management has two prone strategies in place, one is to get away from food packaging and getting into machines on making tarpaulin as well as also catering to manufacturers of woven sack, that is Raffia, an industry which has done very well and the second strategy is to concentrate more on exports. If you see from a global point of view, Rajoo Engineers is still a very small company and India as such has got a very small contribution to exports, so export is a market segment would be growing very fast.

Rafia industry is growing by leaps and bounds, and is expected to continued to grow at 20% to 25%. which is a very good opportunity for the coming quarters.

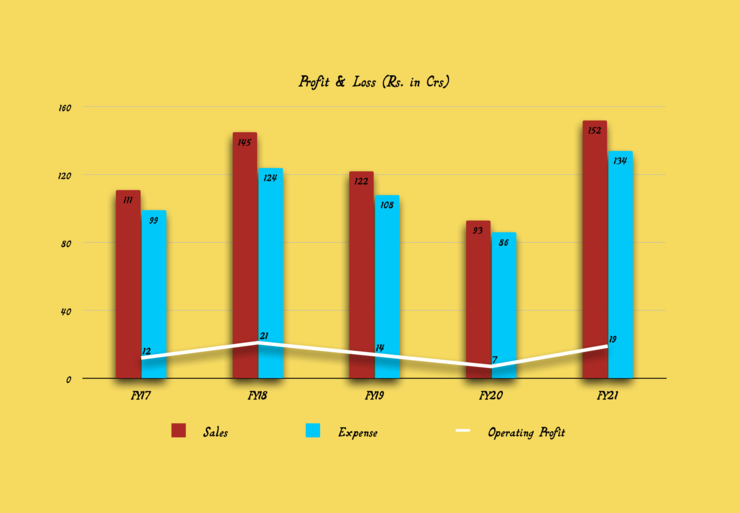

Considering the uncertainty around company expects to continue its growth trajectory to grow at 12% to 15% for another one year and after two to three years, and in case there are any join ventures or mergers which is what company is targeting, then with that probably company would be able to grow at 20% after a year or so as explained by the management. Management has also shown strong confidence that this kind of growth could be possible in the coming period on account of more product lines in the portfolio which company is targeting.

Company does not have nay plans to dilute promoter holdings for the next 2-3 years.

Capex

Company currently has an order book we can say it is Rs. 100 Plus crores as of now and this order book is executable over six to seven months from today.

Company has purchased a land back in 17-18 for around 3 crores and the same as been cleared as Non agriculture land which company plans to develop further for capital expansion. For the coming period company is targeting capex of around 100 crores plus. However so far company is no sure how long would it take to implement it as it is something which company has on its drawing board and is planning accordingly but on a very preliminary stage.

Company currently is operating at around 70% capacity levels.